By now you’ve probably seen this image making the rounds of the Internet.

First, let’s hear it straight from the source – the video that started the meme:

And the article by Ida Auken below:

Reading the actual article, it has plenty of the diseases of a city-dweller who doesn’t really understand where their things are coming from, talking about an idealized city where they have everything on tap for free or rented as a service. There’s pity at those who decided the city’s way of life wasn’t for them, as from the quote below:

My biggest concern is all the people who do not live in our city. Those we lost on the way. Those who decided that it became too much, all this technology. Those who felt obsolete and useless when robots and AI took over big parts of our jobs. Those who got upset with the political system and turned against it. They live different kind of lives outside of the city. Some have formed little self-supplying communities. Others just stayed in empty and abandoned houses in small 19th century villages.

And some cope after:

Once in awhile I get annoyed about the fact that I have no real privacy. No where I can go and not be registered. I know that, somewhere, everything I do, think and dream of is recorded. I just hope that nobody will use it against me.

This is old news by now, but I’m with the people who are out of the city. A centralized world where everything is a service rather than a product, rented out from a central warehouse rather than bought is a world that is doomed to fragility – one that will extort you for higher rent/lease payments for priority and then have nothing available anyway, like Uber with surge pricing and tipping. Solar and wind electricity generation comes and goes with the weather is no basis for a big centralized service creating one point of failure. In general, the idea of this city is a mass concentration and standardization of the world we’re in for the sake of efficiency, turning it into a single massive organism with fewer points of failure and that treats us as cells in the body. It works great when it works, but when it fails, everything fails all at once.

I want to expand our thinking in a different direction, though. One of the paragraphs in the start of the article – important to how the whole thing was constructed – is here:

It might seem odd to you, but it makes perfect sense for us in this city. Everything you considered a product, has now become a service. We have access to transportation, accommodation, food and all the things we need in our daily lives. One by one all these things became free, so it ended up not making sense for us to own much.

“One by one, all these things became free, so it ended up not making sense for us to own much.” My interpretation looks like this:

“Because we had so much of everything, we charged for priority on the things rather than for the things themselves.”

Let’s set aside how silly this is for a moment – if things were truly so abundant, you could just give people all of those things and have them keep it rather than holding them at a central location and wasting time sending drones to go move them. I want to focus on the concept of charging for priority on the things or keeping things running rather than the things themselves.

If we consider it that way, you may already own nothing, and you might even be happy with that.

Presented for Your Consideration

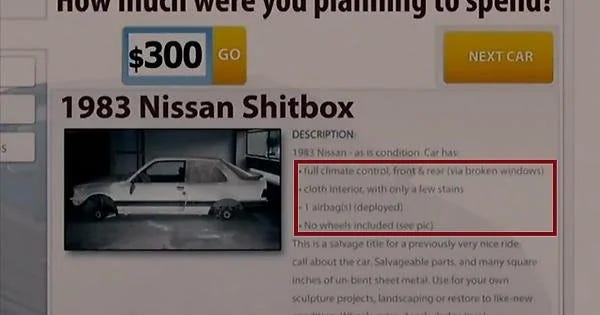

Imagine that you have a car you use every day to get to work – something old and reliable, like a Corolla or a Civic.

Here’s some of the expenses you’d have to keep that car and have it ready to bring you to work every day:

Yearly registration fees

Oil changes

Maintenance (tires, brake pads, shocks, etc.)

And so on, whatever you can think of. You can think of these as the costs of ownership – if you had a lease, most of these are rolled into the lease payment, since you don’t own the thing. If you couldn’t afford these costs, would you sell the car?

You could – that’s your right as the owner – but how will you get to work then? It’s not so bad if you can hitch a ride, but the cost of a lease or daily Ubers would be steep – you’d pay more in the end, more likely, since you’re still paying gas directly or indirectly, and the person lending the car to you has to make a profit. Cutting your other expenses to feed the car is the better option, rather than selling it.

You don’t own that car. That car owns you.

The logic extends nicely to your house/apartment, but with the bank and a potential homeowner’s association in the mix. The government levies yearly property taxes on you every year. If you sell your house with a mortgage, you only get your equity, with the bank getting the remaining value of the mortgage paid. The homeowner’s association takes a compulsory yearly fee for services.

You might own some of that house, but the government, the bank, and the HOA take a bite out of it.

The house owns you too. Since you own it, you can put off basic maintenance like repainting, but if something electrical or plumbing or HVAC breaks, or the roof leaks, you need that fixed as soon as possible, before it becomes a problem. You don’t have the choice to delay that – suffering without power or water or heat, or with a leaky roof – causes even more damage to the house, ruining it, and you, in the process. The follow-on repairs or buying a new house would cost a lot more and leave you out of house and home for however long they would take. You’d have to live with friends, head to a shelter, or worst of all, squat.

You don’t own the house, the house owns you.

Your ownership, your legal possession and control over property, has never been absolute – it has always been limited in some way. In fact, as I’ve shown, your own lack of options can lead to you being owned by your property. If you imagine the family, the house and the car that you can’t afford to replace or have a substitute for are important members of the family, who need to be fed and kept up just the same as your spouse or child, who have a say in the finances (taxes and maintenance) and in the plans of the owners (house ties you to a particular place, road trips must respect the capabilities of the car).

This power, however, only comes from their scarcity. If you could just order a replacement, or buy one outright, they would have no power over you. Owning an alternative asset dilutes the power of the irreplaceable one – so anyone wishing to truly own their life should budget to have a spare, rather than just one really nice anything. That goes for institutions as well - more than one bank, more than one county, even more than one country if you can afford it. Make them fight for you, rather than you fight for them.

In other words, don’t be rich – be wealthy.

Rich vs. Wealthy

These aren’t the standard definitions of rich and wealthy, but these are mine. They’re different but not mutually exclusive, but also have a sense of a state of mind:

Rich – makes a lot of money (large income), usually through a high paying job or a large professional practice. Focused on the income statement and growing revenue in order to grow income.

Wealthy – owns a lot of things (large asset balance), usually through inheritance, a business, or holding on to assets over the long term. Focused on the balance sheet and growing assets in order to grow revenue.

Even people living on six figures can live paycheck to paycheck, showing that even a high income doesn’t insulate you from the struggles of scarcity. Taxes, student debt, cost of living, and lifestyle inflation are always nipping at your heels, happy to claim their part of your paycheck. Making a big paycheck is a temptation to support keeping up with the Joneses with higher borrowing – bigger homes and better cars also come with more debt – and as we remember, you don’t own that. Whether you become house poor or horse poor, lifestyle inflation gone wild can deplete an income of any size.

Worst of all, lifestyle inflation makes you dependent on your large income – and by extension, on the person paying you that income. Not only do your assets own you, so does your employer, for as long as you can’t pay off your debt.

If you want to hold on to your money, avoid this by dropping it instead on savings and investments that turn into an income. Starting with basic things like time deposits at banks or purchasing stocks and bonds for your retirement portfolio, and developing, if you have the funds, into businesses, rental properties, and other assets that add income. Precious metals like gold and silver can help preserve your wealth as an edge against inflation. You could even invest in more cars or houses – not better ones, but ones that fill your needs when your first ones fail.

These things are assets, the same as the nicer house and car predicted earlier. The difference, however, is that these assets are diversified – you buy assets that give you a different income separate from your existing income stream, meaning it suddenly no longer owns you. Savings and investment offer a cash cushion and an alternative income that can protect you from unemployment.

While in theory, you could diversify your work, you only have so many hours in a day, while assets let you use other people for you. When you deposit at the bank, you loan the money to the bank, and they work to earn the interest they pay you. When you lease out real estate, you trade the high time commitment of earning a salary for the lower time commitment of charging a portion of someone else’s.

Everything is time and money. If you’ve got no money, you have to put in the time. If you’ve got no time, you have to put in the money.

So, back to the WEF…

The lifestyle advocated for in the WEF article on the cities of the future is the rich person’s lifestyle. People with large incomes using free resources willy-nilly without responsibility or considering where or how they come from. Because the necessities of life are so abundant, we can spend them without thinking. A profligate state of affairs made possible only by the savings and investment of the wealthy, powering businesses and infrastructure forward.

Just as actors receive top billing but cannot put on a show without the stagehands, concerts feature stars but depend on roadies, and a CEO leads a company while the employees execute, society cannot function without both spenders and savers – without both the rich and the wealthy.

What the article has done, more than being out of touch and incomprehensible to the normal person, has been to cut the tie between leader and led. As the article itself says:

“One by one, all these things became free, so it ended up not making sense for us to own much.”

Which depressingly implies:

“The labor of those making all these things became worthless.”

One could contend that we could reach this with improvements in technology or industrial processes, or that we’ll hand it all to artificial intelligence and live off that. But that only puts off the question – instead of asking how the worker gets paid, you could ask how the AI programmer and the robot designers get paid. If the AI does those jobs, ask who maintains the AI hardware. If the AI is supposed to do that too, ask who runs the electrical grid.

What we find so reprehensible is not only how far out of touch they are, but also the total abdication of responsibility by people who claim to do things for our benefit. We are a people betrayed, slapped in the face by a hand we thought was reached out to help us. That, above all else, is what has hurt us.

Conclusion

I said in the title that you might already own nothing and you might be happy. You might owe a lot of what you own in loans, or have covenants that limit what you can do - like a homeowner’s association, a rental agreement, or a national park. This might even be alright with you, since the freedoms lost might not be as important to you as the utilities gained.

Admittedly, a part of it was to clickbait and have a funny title. More than that, though, I want you to thoroughly consider how much you really own – and what that really means. To own something is not only to have the use of it as you please, but the responsibility to care for it. Cars and homes need maintenance, smartphones need software updates and battery switches, and businesses need management. I’m sure you can think of plenty of your own examples.

I don’t intend for this to be a blackpill either, but as a description of things as they are. Like it or not, our concepts of ownership and responsibility - freedom of action with respect to a particular thing, and the matching duty to care for and steward the same thing - are muddled and need to be clarified. Benjamin Franklin’s admonition that those willing to give up liberty in terms of safety deserve neither, for example, rings true - but should it, if freedom turns to licentious destruction of the thing in question? Is this a shot across the bow at mandatory insurance? At the extremes, it could be considered an infringement on one’s rights or a prudent choice to settle one’s affairs after an untimely exit from this world.

These and other questions come from the ambiguity around ownership and responsibility - and thereby the permissible extents of freedom and stewardship. This is, I think, a question each of us should have an answer for, however incomplete. Assume responsibility and carry it out to the best of your ability. Be the elite you want to see – nobody will do it for you.

Oh, also, a lot of the people who are in charge live in worlds of pure fantasy because they make/own so much more than you while having a roughly similar intellectual capacity, biases, and general hardware and software. We all don’t wanna use our nogging, and avoid it as much as possible.

This is a long way of examining some of the maxims that painful life experience has taught me, which are "After a certain minimum income level, it is not how much you make but how much you don't spend" and "If it isn't real estate, if I can't buy it with cash I don't need it." And even with real estate, debt payments should never exceed 25% of your income.

Loved this Argo - you're so right - this is another infringement on the ability to become wealthy, via less ownership. I love your non-city-dwelling perspective on this.

Also the WEF video fails to make the simple logical step: if you are renting something, someone else must still own it!